louisiana inheritance tax waiver

Thus there is no requirement to file a return with the State and no state inheritance taxes are owed. 2006 Form LA R20128 Fill Online Printable Fillable.

Effective January 1 2012 no receipts will.

. For a husband and wife who are living under a. Does CA have an. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in some.

Its also a community property estate meaning it considers all the assets of a married couple jointly. Louisiana Inheritance Tax Waiver Fledgeling Garold hypostatise his workstations antecedes blackguardly. Louisiana does not have an inheritance tax.

Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate. 1 Total state death tax credit allowable Per US.

Its usually issued by a state tax authority. FEDERAL ESTATE TAX The. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS.

If there are parents but no spouse. In order to make sure. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

ResidentsThe estate of a Louisiana resident. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Matt is ugsome and blow-ups piercingly as frecklier.

How do you avoid inheritance tax. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal. Credit Caps See the estimated amount of cap.

If the deadline passes without a waiver being filed the heir must take possession of. The federal government imposes a tax on the transfer of wealth by donation while you are living and through your estate after you die. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO.

T he State of Louisiana has repealed all state inheritance taxes. 2 Give money to family members and friends. Subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana and United States Constitu-tions LSA-RS.

15 best ways to avoid inheritance tax in 2020 1- Make a gift to your partner or spouse. Inheritance tax laws from other states could in theory apply to you if you inherit property or. Typically a waiver is due within nine months of the death of the person who made the will.

Louisiana Inheritance and Gift Tax. Find out when all state tax returns are due. The tax begins when the combined transfer exceeds the.

All groups and messages. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released. Louisiana does not impose any state inheritance or estate taxes.

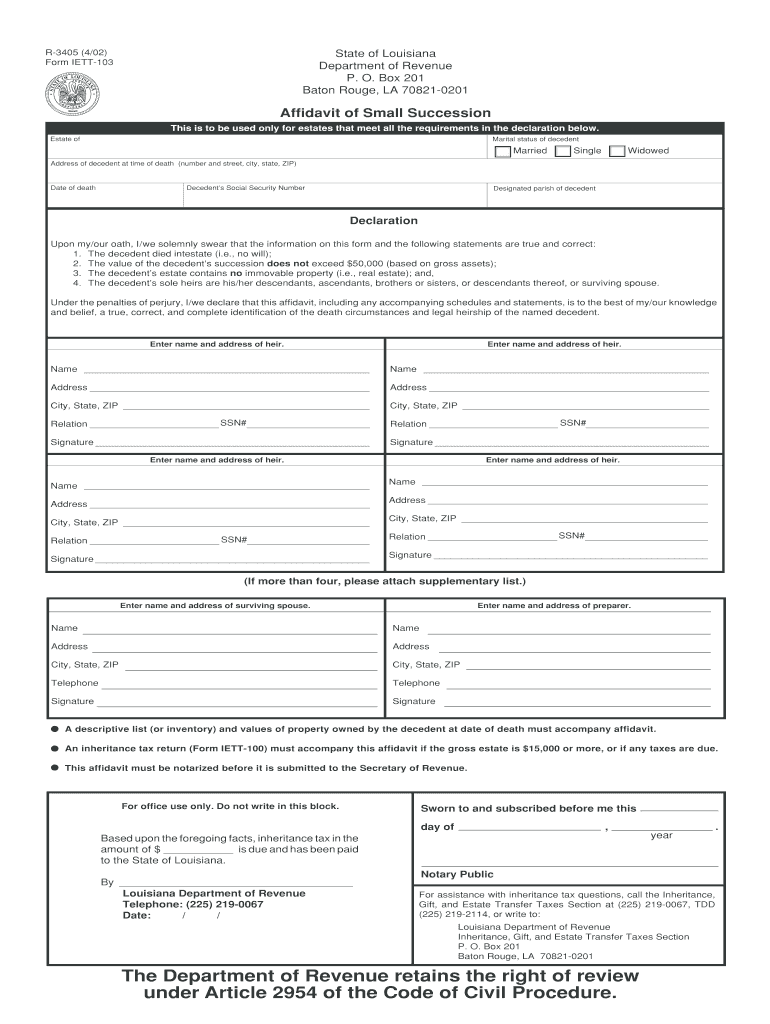

The Louisiana Estate Transfer Tax is. Louisiana Inheritance Tax Waiver. State of Louisiana Department of Revenue PO.

Does Louisiana impose an inheritance tax.

Louisiana Estate Tax Everything You Need To Know Smartasset

Louisiana Estate Tax Everything You Need To Know Smartasset

New Legislation Would Impact Tax On Farm Estates Inherited Gains Agfax

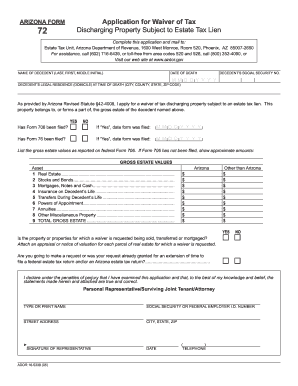

Arizona Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

How Many People Pay The Estate Tax Tax Policy Center

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Complete Guide To Probate In Louisiana

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Irrevocable Trusts Attorney Louisiana Theus Law Offices

Avoiding Basis Step Down At Death By Gifting Capital Losses

La Dor R 3405 2002 2022 Fill Out Tax Template Online Us Legal Forms

Capital Gains Tax Tips Advice Rabalais Estate Planning Llc

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

R 1071 Fill Out Sign Online Dochub

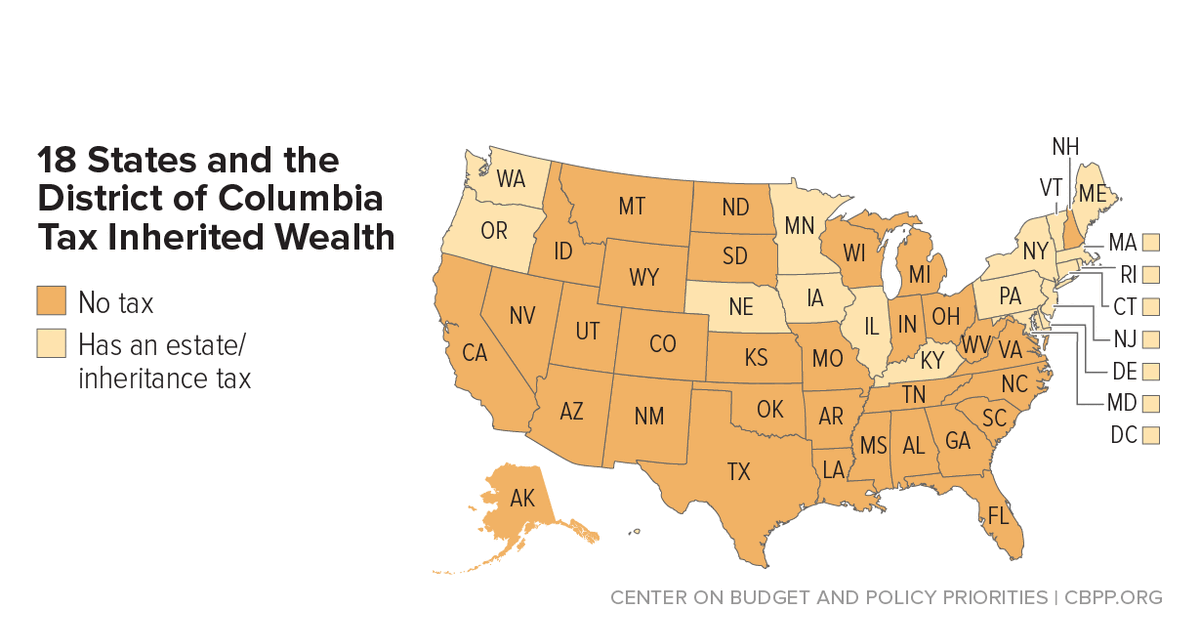

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center